CA to Kelly O: You Owe $30k & Cha-Cha-Change

CA to Kelly O: You Owe $30k & Cha-Cha-Change

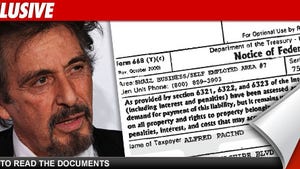

Kelly Osbourne better have some of her "Dancing with the Stars" money left -- because the State of California claims she owes over $30k in back taxes from the year she appeared on the show.

According to documents filed in L.A. County, and obtained by TMZ, Kelly owes $34,763.30 in unpaid taxes from 2009.

That's the year she placed 3rd on "DWTS" ... and we all know celebs don't wear spandex for free.

Calls to her reps have not been returned.